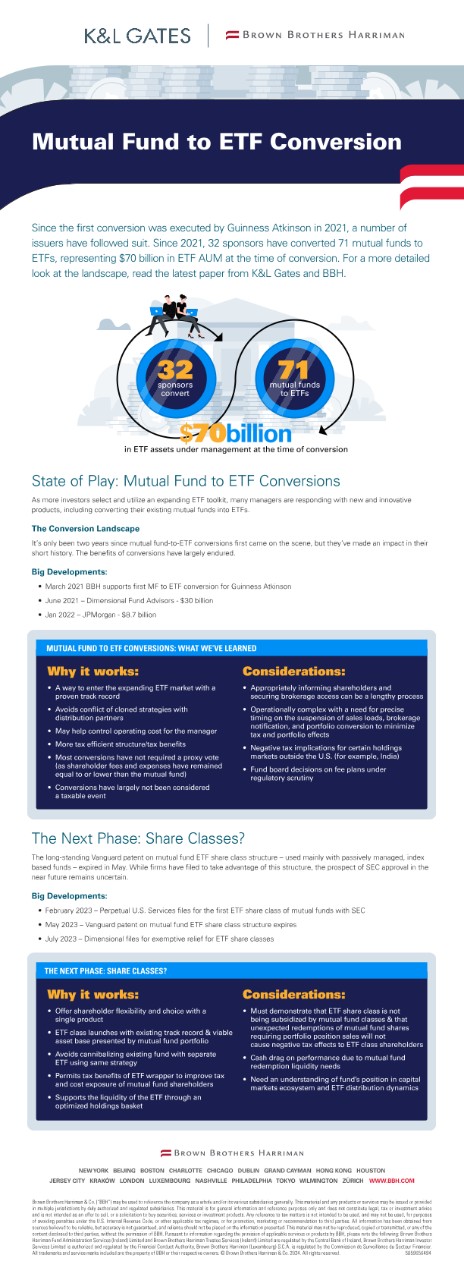

As actively managed ETFs continue to gain industry and investor interest, BBH and Peter Shea, Partner and Co-Head of ETF Practice at K&L Gates, have partnered up to discuss the lessons learned on mutual fund to ETF conversions and what’s ahead for the ETF industry.

1See NYSE and trackinsight’s joint website, ETF Central, “ETF Industry KPIs – 11/6/23” by ETF Think Tank (https://www.etfcentral.com/etf-u/news/this-week-the-industry-experienced-14-etf-launches).

2Rule 6c-11 (the “ETF Rule”) promulgated under the Investment Company Act of 1940 (“1940 Act”). Rule 6c 11(a)(2) provides: “Notwithstanding the definition of exchange-traded fund . . . of this section, an exchange-traded fund is not prohibited from selling (or redeeming) individual shares on the day of consummation of a reorganization, merger, conversion or liquidation, and is not limited to transactions with authorized participants under these circumstances.”

3See Final Rule Adopting Release, SEC Nos. 33-10695 & IC-33646, “Exchange-Traded Funds” at 121-125 (Sept. 25, 2019) (https://www.sec.gov/rules/2019/09/exchange-traded-funds#33-10695). The ETF Rule’s adopting release noted that the rule did not provide regulatory relief to permit share class ETFs, although the SEC expressed an interest in leveling the playing field once share class policy considerations were adequately addressed through the SEC’s exemptive relief application and order process.

4See, for example, Perpetual US Services, LLC, Application for Exemptive Relief (Feb. 8, 2023) (https://www.sec.gov/Archives/edgar/data/1965046/000121390023009034/s149241_40app.htm); and Dimensional Fund Advisors LP, et al., Application for Exemptive Relief (July 12, 2023) (https://www.sec.gov/Archives/edgar/data/355437/000168035923000216/dimensional40app07122023.htm) (ETF class of a mutual fund); and F/m Investment LLC, et al., Application for Exemptive Relief (Aug. 22, 2023) (https://www.sec.gov/Archives/edgar/data/831114/000089418923006022/rbb-fm_40-app.htm) (Mutual fund class of an ETF).

5See Vanguard Index Funds, Rel. Nos. IC-24680 (Oct. 6, 2000) (notice) and IC-24789 (Dec. 12, 2000) (order); Vanguard Index Funds, Rel. Nos. IC-26282 (Dec. 2, 2003) (notice) and IC-26317 (Dec. 29, 2003) (order); Vanguard International Equity Index Funds, Rel. Nos. IC-26246 (Nov. 3, 2003) (notice) and IC-26281 (Dec. 1, 2003) (order); Vanguard Bond Index Funds, Rel. Nos. IC-27750 (Mar. 9, 2007) (notice) and IC-27773 (Apr. 25, 2007) (order).

BBH makes no representations, guarantees or warranties of any kind regarding information provided by third party sources. Any such information is intended for informational purposes only and any views or opinions expressed therein are of that third party.

Brown Brothers Harriman & Co. (“BBH”) may be used to reference the company as a whole and/or its various subsidiaries generally. This material and any products or services may be issued or provided in multiple jurisdictions by duly authorized and regulated subsidiaries. This material is for general information and reference purposes only and does not constitute legal, tax or investment advice and is not intended as an offer to sell, or a solicitation to buy securities, services or investment products. Any reference to tax matters is not intended to be used, and may not be used, for purposes of avoiding penalties under the U.S. Internal Revenue Code, or other applicable tax regimes, or for promotion, marketing or recommendation to third parties. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed, and reliance should not be placed on the information presented. This material may not be reproduced, copied or transmitted, or any of the content disclosed to third parties, without the permission of BBH. Pursuant to information regarding the provision of applicable services or products by BBH, please note the following: Brown Brothers Harriman Fund Administration Services (Ireland) Limited and Brown Brothers Harriman Trustee Services (Ireland) Limited are regulated by the Central Bank of Ireland, Brown Brothers Harriman Investor Services Limited is authorised and regulated by the Financial Conduct Authority, Brown Brothers Harriman (Luxembourg) S.C.A is regulated by the Commission de Surveillance du Secteur Financier. All trademarks and service marks included are the property of BBH or their respective owners. © Brown Brothers Harriman & Co. 2024. All rights reserved. IS-09617-2024-02-07