Price/Earnings (PE) ratio is a company’s current share price divided by earnings per share.

Turnover ratio is the rate of trading in a portfolio; higher values imply more frequent trading.

A margin of safety exists when we believe there is a significant discount to intrinsic value at the time of purchase. Intrinsic value is an estimate of the present value of the cash a business can generate over its remaining life.

The Representative Account is managed with the same investment objectives and employs substantially the same investment philosophy and processes as the Strategy.

Each investor’s portfolio is individually managed and may vary from the information shown. The representative account may change from time to time.

The S&P 500 is an unmanaged weighted index of 500 stocks providing a broad indicator of stock price movements.

The composition of the index is materially different than the Strategy’s holdings. An index is not available for direct investment.

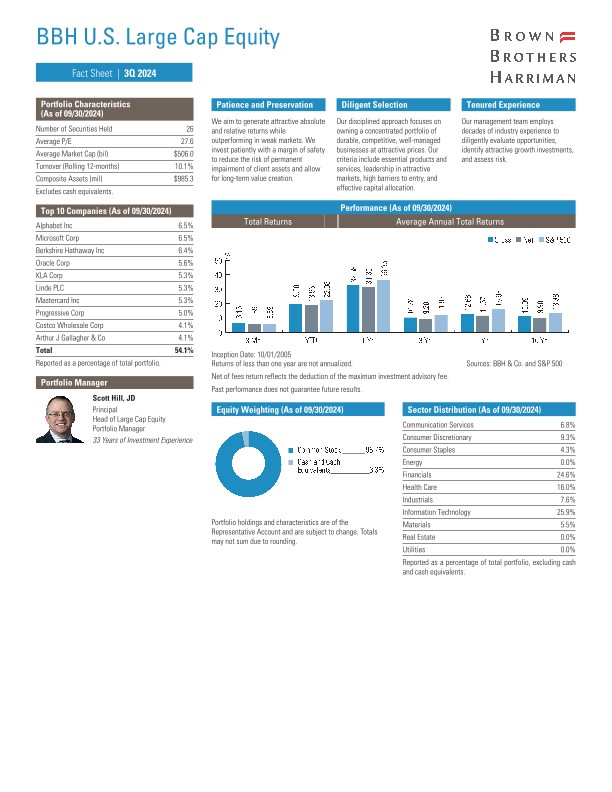

Gross of fee performance results for this composite do not reflect the deduction of investment advisory fees. Net of fees performance results reflect the deduction of the maximum investment advisory fees. Returns include all dividends and interest, other income, realized and unrealized gain, are net of all brokerage commissions and execution costs. Performance calculated in U.S. dollars.

Risks

Investors should be able to withstand short-term fluctuations in the equity markets in return for potentially higher returns over the long term. The value of portfolios changes every day and can be affected by changes in interest rates, general market conditions, and other political, social, and economic developments.

The Strategy may assume large positions in a small number of issuers which can increase the potential for greater price fluctuation.

International investing involves special risks including currency risk, increased volatility, political risks, and differences in auditing and other financial standards.

There can be no assurance the Strategy will achieve its investment objectives.

Brown Brothers Harriman Investment Management (“IM”), a division of Brown Brothers Harriman & Co (“BBH”), claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To receive additional information regarding IM, including a GIPS Composite Report for the Strategy, contact John Ackler at 212-493-8247 or via email at john.ackler@bbh.com.

The objective of our US Large Cap Equity Strategy is to provide investors with long-term growth of capital and generate attractive returns over full economic cycles. The

Composite includes all fully discretionary, fee-paying accounts with an initial investment equal to or greater than $5 million that invest in a portfolio of approximately 25-35 companies with market capitalizations greater than $5 billion that are headquartered in North America, as well as in certain global firms located in other developed regions. Accounts that subsequently fall below $4.5 million are excluded from the Composite.

Brown Brothers Harriman & Co. (“BBH”) may be used to reference the company as a whole and/or its various subsidiaries generally. This material and any products or services may be issued or provided in multiple jurisdictions by duly authorized and regulated subsidiaries. This material is for general information and reference purposes only and does not constitute legal, tax or investment advice and is not intended as an offer to sell, or a solicitation to buy securities, services or investment products. Any reference to tax matters is not intended to be used, and may not be used, for purposes of avoiding penalties under the U.S. Internal Revenue Code, or other applicable tax regimes, or for promotion, marketing or recommendation to third parties. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed, and reliance should not be placed on the information presented. This material may not be reproduced, copied or transmitted, or any of the content disclosed to third parties, without the permission of BBH. All trademarks and service marks included are the property of BBH or their respective owners. © Brown Brothers Harriman & Co. 2024. All rights reserved.

Not FDIC Insured No Bank Guarantee May Lose Money

IM-15420-2024-10-15 Exp. Date 01/31/2025